Ameresco Reports Third Quarter 2021 Financial Results

– Diversified Model and Favorable Business Mix Drive Profit Growth –

– Significant Growth in Awarded Backlog –

– Announced Transformational Battery Storage Design/Build Contract –

– Raising FY21 Guidance Ranges –

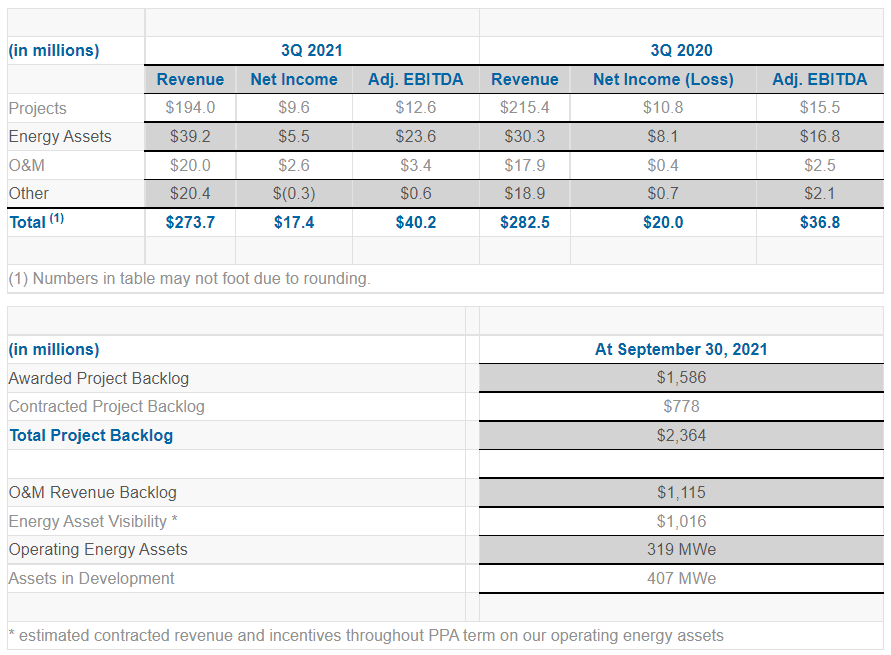

Third Quarter 2021 Financial Highlights:

- Revenues of $273.7 million

- Net income of $17.4 million and GAAP EPS of $0.33

- Non-GAAP net income of $21.9 million, up 18% year-over-year

- Non-GAAP EPS of $0.41, up 8%

- Adjusted EBITDA of $40.2 million, up 9%

FRAMINGHAM, Mass. — Ameresco, Inc. (NYSE:AMRC), a leading cleantech integrator specializing in energy efficiency and renewable energy, today announced financial results for the fiscal quarter ended September 30, 2021. The Company has also furnished supplemental information in conjunction with this press release in a Current Report on Form 8-K. The supplemental information includes non-GAAP financial metrics and has been posted to the “Investor Relations” section of the Company’s website at www.ameresco.com.

“Third quarter results demonstrated the strength and resiliency of our diversified business model, as a favorable business mix resulted in profit growth, despite supply chain disruptions and COVID-19 related delays in our Projects line of business. Our higher margin recurring Energy Asset revenue increased by nearly 30% as we continued to add new assets to our expanding operating portfolio. Together with our O&M business, these groups provide over two thirds of our Adjusted EBITDA along with over $2 billion in long term revenue visibility,” said George P. Sakellaris, President and Chief Executive Officer.

“A key takeaway from our third quarter performance was the acceleration of our business development activities, which we expect to support Ameresco’s continued growth in the periods ahead. Our awarded backlog at the end of the third quarter increased 11% sequentially and 31% compared to last year, and we experienced robust bidding activity across our entire platform of advanced technology solutions.

In late October, we announced a transformational contract to provide a 537.5 MW / 2.150 GWh multisite battery energy storage system (BESS) for Southern California Edison (SCE). This design/build project will deliver increased grid reliability to areas that have felt the impact of extreme weather in California. It represents the largest contract in Ameresco’s history and is emblematic of the complexity, scope and size of the opportunities that are emerging. It also highlights the demand for more comprehensive projects that utilize advanced clean energy technologies in which Ameresco has deep domain expertise. Past investments in bringing on leading advanced technology experts and our proven track record of executing on highly complex projects provide us with a distinct competitive advantage.”

Third Quarter Financial Results

(All financial result comparisons made are against the prior year period unless otherwise noted.)

Total revenue was $273.7 million, compared to $282.5 million the previous year. Project revenue declined by 10% as approximately $30 million worth of Projects revenue was delayed due to supply chain constraints and COVID-19 related restrictions. We anticipate the COVID-19 and supply chain challenges to continue into 2022 and factored this into our updated guidance below. Conversely, Energy Asset revenue increased 29% reflecting the continued growth of our operating portfolio, increased performance of existing assets and strength in renewable identification numbers (RINs) realized prices. O&M revenue increased 12% as we continue to attach long-term O&M contracts to our project work. Gross margin of 21.5% increased sequentially and year-over-year as our revenue mix continued to shift towards the Company’s higher margin Energy Assets and O&M businesses. Operating income was $23.6 million and operating margin was 8.6%. Net income attributable to common shareholders was $17.4 million and GAAP EPS was $0.33. The GAAP results for 2021 reflect non-cash downward adjustments of $2.9 million related to non-controlling interest activities and $1.9 million related to an energy asset impairment charge. The GAAP results for 2020 reflect a non-cash upward adjustment of $2.3 million related to non-controlling interest activities and a non-cash downward adjustment of $1.0 million related to an energy asset impairment charge. Excluding these adjustments, 2021 Non-GAAP net income was $21.9 million compared to $18.5 million, an increase of 18%. Adjusted EBITDA, a Non-GAAP financial measure, increased 9% to $40.2 million, and Non-GAAP EPS was $0.41 compared to $0.38.

Project Highlights

In the third quarter of 2021:

- Ameresco was one of eight prime contract awardees selected by the Naval Facilities Command Mid-Atlantic (NAVFAC MIDLANT) for a 5-year $950 million construction contract vehicle.

- During the quarter Ameresco announced a number of Smart Water Metering projects including with the Texas cities of El Campo, Mesquite, Bellmead and Seabrook, highlighting the increased demand for advanced water infrastructure solutions.

Asset Highlights

In the third quarter of 2021:

- Ameresco brought 4 MWe into operation while adding 35 MWe (gross) to our Assets in Development, bringing our total to 407 MWe.

- The Company placed three Massachusetts based solar assets into operation.

- We increased our Assets in Development by adding four new RNG plants and a battery storage asset to an operating solar plant.

Summary and Outlook

“Ameresco is exceptionally well positioned for continued growth in the periods ahead. Our strong year-to-date performance and recent contract wins reflect our ability to capture share of an increasingly expanding addressable market.

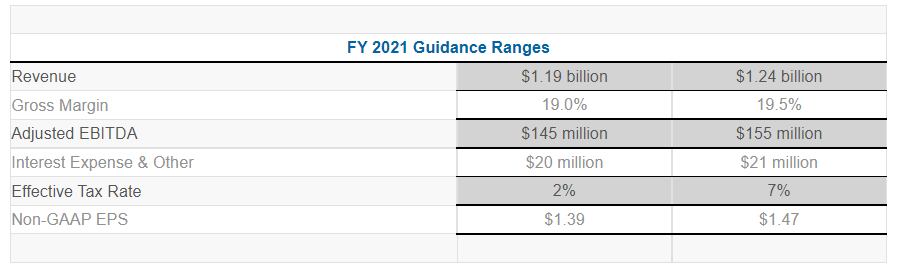

Given our strong year-to-date performance, our recently announced BESS contract and a lower than expected tax rate, we are pleased to be raising our FY 2021 Guidance Ranges as shown in the table below. This also reflects an increased investment in our people, new resources and growth strategies. The Company anticipates commissioning approximately 30 MW of additional energy assets and plans to invest approximately $70 million to $120 million in additional energy asset capital expenditures during the remainder of 2021, the majority of which will be funded with project finance debt.

The SCE contract will be an important driver of Ameresco’s 2022 financial results. We also believe it is transformational as it demonstrates the increasing need for climate friendly resiliency and grid reliability. We are looking forward to continued progress in this year’s fourth quarter and to a year of substantial revenue and profit growth in 2022,” Mr. Sakellaris noted.

Conference Call/Webcast Information

The Company will host a conference call today at 4:30 p.m. ET to discuss results. The conference call will be available via the following dial in numbers:

- U.S. Participants: Dial +1 (877) 359-9508 (Access Code: 9934159)

- International Participants: Dial +1 (224) 357-2393 (Access Code: 9934159)

Participants are advised to dial into the call at least ten minutes prior to register. A live, listen-only webcast of the conference call will also be available over the Internet. Individuals wishing to listen can access the call through the “Investor Relations” section of the Company’s website at www.ameresco.com. An archived webcast will be available on the Company’s website for one year.

Use of Non-GAAP Financial Measures

This press release and the accompanying tables include references to adjusted EBITDA, Non- GAAP EPS, Non-GAAP net income and adjusted cash from operations, which are Non-GAAP financial measures. For a description of these Non-GAAP financial measures, including the reasons management uses these measures, please see the section following the accompanying tables titled “Exhibit A: Non-GAAP Financial Measures”. For a reconciliation of these Non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with GAAP, please see Non-GAAP Financial Measures and Non-GAAP Financial Guidance in the accompanying tables.

About Ameresco, Inc.

Founded in 2000, Ameresco, Inc. (NYSE:AMRC) is a leading cleantech integrator and renewable energy asset developer, owner and operator. Our comprehensive portfolio includes energy efficiency, infrastructure upgrades, asset sustainability and renewable energy solutions delivered to clients throughout North America and the United Kingdom. Ameresco’s sustainability services in support of clients’ pursuit of Net-Zero include upgrades to a facility’s energy infrastructure and the development, construction, and operation of distributed energy resources. Ameresco has successfully completed energy saving, environmentally responsible projects with Federal, state and local governments, healthcare and educational institutions, housing authorities, and commercial and industrial customers. With its corporate headquarters in Framingham, MA, Ameresco has more than 1,000 employees providing local expertise in the United States, Canada, and the United Kingdom. For more information, visit www.ameresco.com.

Safe Harbor Statement

Any statements in this press release about future expectations, plans and prospects for Ameresco, Inc., including statements about market conditions, pipeline and backlog, as well as estimated future revenues, net income, adjusted EBITDA, Non-GAAP EPS, other financial guidance and other statements containing the words “projects,” “believes,” “anticipates,” “plans,” “expects,” “will” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward looking statements as a result of various important factors, including the timing of, and ability to, enter into contracts for awarded projects on the terms proposed; the timing of work we do on projects where we recognize revenue on a percentage of completion basis, including the ability to perform under recently signed contracts without unusual delay; demand for our energy efficiency and renewable energy solutions; our ability to arrange financing for our projects; changes in federal, state and local government policies and programs related to energy efficiency and renewable energy; the ability of customers to cancel or defer contracts included in our backlog; the effects of our recent acquisitions and restructuring activities; seasonality in construction and in demand for our products and services; a customer’s decision to delay or cancel our work on, or other risks involved with, a particular project; availability and cost of labor, including in response to vaccine mandates; availability and cost of equipment, as impacted by ongoing supply chain disruptions; the addition of new customers or the loss of existing customers; market price of the Company’s stock prevailing from time to time; the nature of other investment opportunities presented to the Company from time to time; the Company’s cash flows from operations; and other factors discussed in our Annual Report on Form 10-K for the year ended December 31, 2020, filed with the U.S. Securities and Exchange Commission (SEC) on March 2, 2021 and in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, filed with the SEC on August 3, 2021. Currently, one of the most significant factors, however, is the potential adverse effect of the current COVID-19 (and its variants) pandemic on our financial condition, results of operations, cash flows and performance and the global economy and financial markets. The extent to which COVID-19 impacts us, suppliers, customers, employees and supply chains will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures, among others. Moreover, you should interpret many of the risks identified in our Annual Report as being heightened as a result of the ongoing and numerous adverse impacts of COVID-19. In addition, the forward-looking statements included in this press release represent our views as of the date of this press release. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

Full press release available: https://ir.ameresco.com/news-events/press-releases/detail/481/ameresco-reports-third-quarter-2021-financial-results

Contact: